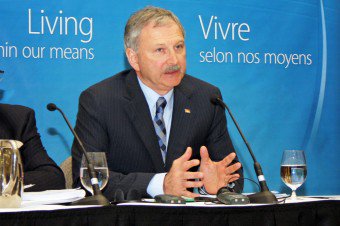

New Brunswick Finance Minister Blaine HIggs delivering the 2014 – 2015 Budget Speech.

Community economic development organizations in New Brunswick have new financing avenues to bolster access to capital for their local CED initiatives. In their budget this week, the provincial government announced the creation of Community Economic Development Investment Funds (CEDIF) and the extension of their Small Business Tax Investor Credit (SBTIC) to these CEDIFs.

CEDIFs are pools of capital from individuals, corporations and trusts within a defined community that are used to operate or invest in businesses within the defined community – a big boon to local CED initiatives. CEDIFs have been used with great success in other jurisdictions – since 1999, Nova Scotia has seen 48 CEDIFs established, mobilizing 7500 investors, with total assets at more than $56 million. (See CCEDNet’s webinar on Nova Scotia CEDIFs for more)

The SBTIC already allowed New Brunswick individuals to invest up to $500,000 in New Brunswick businesses for a 30% tax credit. This change extends eligilibility to corporations and trusts, for a 15% non-refundable corporate income tax credit on eligible investments up to $500,000, and includes CEDIFs as an eligible investment vehicle.

Access to capital is as big or bigger a hurdle to co-operatives and social enterprises as it is to small businesses, and this program will open up new financing avenues for innovative projects strengthening New Brunswick communities. Congratulations to CCEDNet members like the Co-operative Enterprise Council of New Brunswick who have been working towards this announcement.

More